A lover of stories, parks, animals, rainy days, and hot…

Every year, many of us are determined to be better at managing our finances, sticking to our budgets, and finding ways to become financially independent. The resolve is especially strong in January: you’ve blown away your savings during the holidays buying presents for everyone, paying for the airfare home, treating your family to an outing, drinking out with friends from school, etc.

For sure, all that expense was all worth it, and you’d do it all over again. Probably still didn’t stop your heart from breaking, though, when you finally peeked at your bank statement again (the last time being a week before the holidays, just before you indulged in the merry season like a home-bound OFW bearing gifts for the entire barangay).

Life is back to your proverbial normal now, and you must have quickly realized the stark reality of your financial situation. I know I did.

As you — we — find our way back to financial health, it won’t hurt to pick up a few money management habits which we can carry through the entire year.

1. Commit to a Spending Hiatus.

Photo by BBH Singapore on Unsplash

The best way to financially recover is to stop spending money for anything apart from the essentials. No buying new clothes, gadgets, and accessories you don’t really need. Cook your meals at home instead of dining out every night, and go home early if you must use public transport instead of booking a Grab.

Here’s a tip: take out a calendar and mark the dates when you must spend or pay for something, like your anniversary, your dad’s birthday, and the due dates for your rent and car loan, etc. If there’s a week per month where you don’t have any fixed dues, mark it as your spending hiatus week.

January is the best time to start. You can go as far as extending your spending lockdown for the entire first quarter, but then you’d have to break your promise if you need to plan something special for February 14.

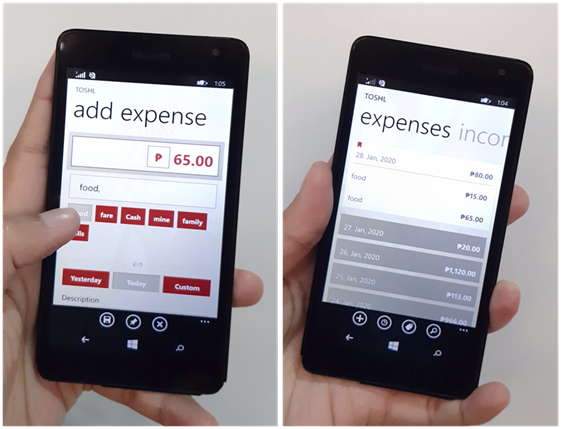

2. Use Mobile Apps to Record Your Daily Expenses

Photos from the writer

Story time.

There was once a lady who liked to pay with her credit card whenever it’s possible. She buys groceries, swipe. Oh, what a fab pair of shoes—swipe. Her friends invite her out for lunch at a resto, swipe. She goes to Starbucks, swipe. Does it again on Wednesday, Thursday, and Saturday. A few days later, she breaks out in cold sweat as she reviews her credit card statement on her phone: her upcoming bill would wipe out what she’ll receive on the next pay period.

It’s a classic tale of indulging in cashless shopping, and then bitterly regretting the aftermath. Spending money is easy; keeping track of it isn’t.

Thank goodness for free budgeting apps. I use a very simple one myself: Toshl. Travel photographer and blogger, Ferdz Decena has a fantastic review about it on his blog.

No matter which money management app you use, my advice is to keep things simple.

For instance, I only use five tags or categories for my expenses: Food, Fare, Bills, Family (anything I spend for my family), and Mine (personal expenses that don’t fall under any of the above). I see at a glance how much I’m spending for each category, and since I already know how much I should be spending for each, I can quickly adjust my weekly expenditures.

3. Schedule Your Payables for Each Pay Period

Weekly food budget, transportation budget, rent, monthly loan payments, insurance premiums and other non-negotiables make up your fixed budget. If you receive your salary once a month, it’s easy to set aside the money for these payables. If, however, you’re paid twice a month and each payout isn’t enough to cover all your fixed expenses, you need to create a payment schedule.

Plan which payables to cover for each payout. Below is an example:

| Salary on the 1st of the Month: P30,000 | Salary on the 15th of the Month: P27,000 |

| Payables: | Payables: |

| Rent – P15,000

Food budget (for the next four weeks) – P7,000 Electric bill (monthly average) – P3,000 Extra: P5,000 |

Insurance premium – P4,000

Loans – P10,000 Phone bill – P1,500 Transportation budget (for the next four weeks) – P5,000 Water bill (monthly average) – P1,000 Extra: P5,500

|

This is one of the easiest money management techniques, and one that every Modern Filipina should practice. It helps you stay in control of your expenses: you’ll know how much money you have left for non-essentials, so you’re less likely to spend more than what you earn each month.

4. Treat Savings as a Fixed Expense

Photo by Fabian Blank on Unsplash

Any financial adviser would tell you to set something aside for savings first. It’s a must if you want to set up an emergency fund.

Consider the example above. With a total extra of P10,500 per month, you can set aside half of that for your savings. P5,500 is almost 10 percent of a monthly salary of P57,000. That’s 50 percent short of the widely recommended 50/30/20 saving scheme, but one that’s still a lot better than zero savings.

The beauty of this strategy is you can start small — a couple of thousand per payout — and you’re free to gradually increase the amount as you get used to the habit of saving.

Don’t Give Up on Money Management

There will be days when you’ll overshoot your budget for those must-not-miss opportunities that cost money, or an emergency will come up that will blow your budget to dust. You’ll also be tempted to keep spending on what you want all the time.

But give yourself credit: you’re stronger and more disciplined than you think. Just put your mind to it, and you can succeed at managing your finances, not just in 2020 but also in the years to come.

What's Your Reaction?

A lover of stories, parks, animals, rainy days, and hot chocolate, she believes that the best remedies for bad days are three servings of french fries and one whole rainbow cake.